Guide to getting a property loan in Singapore FAST

For many Singaporeans, home ownership is an important life goal and marks a major milestone in their lives. With the current Covid situation which has pushed the interest rates downwards, many opportunist might want to take this chance to purchase a new apartment.

However, the criteria to purchasing real estate has become more complex.

This guide aims to help you understand the various factors at play and how that will affect your chances of getting a property loan in Singapore.

What is an in-principle approval (IPA)?

An in-principle approval is offered by a bank, as an assurance that they will loan you up to a certain amount of money. With this, you can start house-hunting with a budget in mind and not worry about finding that you can’t eventually afford your dream home.

An IPA is not an exclusive agreement with a bank, and you can get multiple IPAs from different banks in Singapore. Some mortgage consultants may also help you find the best deal to getting a property loan in Singapore, for a referral fee from the bank.

How do I get an in-principle approval (IPA)?

You can visit a bank branch and submit a form, along with some documents to show your current financial health. Very often, banks will ask for your employment documents to determine how much to loan you:

Most recent payslips for the last 2 months

Income tax notice of assessment

Latest CPF statement

For self-employed or commission-based workers, you may also be required to show additional proof of income through invoices or receipts. The time a bank will take to prepare the IPA varies, but allow a week or two get the paperwork sorted.

What will a bank use to determine the loan amount?

Several factors play a part, including the government-mandated loan rations (MSR and TDSR) and the bank’s risk appetite.

The Mortgage Servicing Ratio (MSR) for HDB and EC

The mortgage servicing ratio (MSR) limits the loan servicing amount of a HDB flat or an executive condominium apartment to 30% of your salary. The maximum tenure of a HDB and an EC loan is 25 years and 30 years respectively. This in turn will determine how much loan can be given to you.

If you bought a HDB flat before 10 Jan 2013, or an EC apartment before 10 Dec 2013, this restriction would also not apply if you wanted to refinance your loan.

The Total Debt Servicing Ratio (TDSR) for all residential property

The TDSR works the same way as the MSR, but it encompasses a larger scope. This total includes car loans, study loans, credit card loans… everything!

Basically, it limits your total loan servicing amount to 60% of your salary.

In general this ratio impacts you more if you are servicing multiple mortgages.

Do note that if you draw sales commissions, the TDSR is further reduced by considering only 70% of your income.

Income weighted average

The loan tenure when getting a property loan in Singapore is shorter for an older applicant. This is because it is harder to support the loan, once the applicant stops working in old age. To bypass this restriction, many loan applicants would purchase a property together with a younger person.

With the new TSDR rules, the loan tenure averages out for both applicants. The bank would calculate the income-weighted average age with this formula:

([Applicant A income x Applicant A age) + (Applicant B income + Applicant B age)] / (Applicant A income + Applicant B income)

Interest rate of 3.5% or 4.5% as stress test

As monetary measures have reduced the interest rates to below the long-term average, banks do not use the 1-2% rate as their benchmark to determine how well you can repay your loans. Instead, a 3.5% and 4.5% interest rate applies for residential and commercial properties respectively.

Financial assets are valued less

Besides using the monthly salary to apply for a loan, some applicants use assets like stocks, bonds and paid-up properties. Asset-based lending is now harder, as banks will use 70% of the total value of the asset as collateral.

What kind of property loan can I apply for?

There are several types of property loans in the market today:

- Fixed Rate Mortgages

- SIBOR Pegged Mortgages

- SOR Pegged Mortgages

- SORA Pegged Mortgages

- Board Rate Mortgages

- Deposit Matching Interest Offset Mortgages

- HDB Housing Loan Mortgages

- Fixed Deposit Pegged Home Loan Mortgages

1. Fixed Rate Mortgages

A fixed rate mortgage allows for instalments paid on a pre-determined interest rate, and is usually fixed for a period of 1 to 5 years. This type of mortgage thus offers stability in exchange for reduced flexibility in redeeming the loan partially or in full.

2. SIBOR Pegged Mortgages

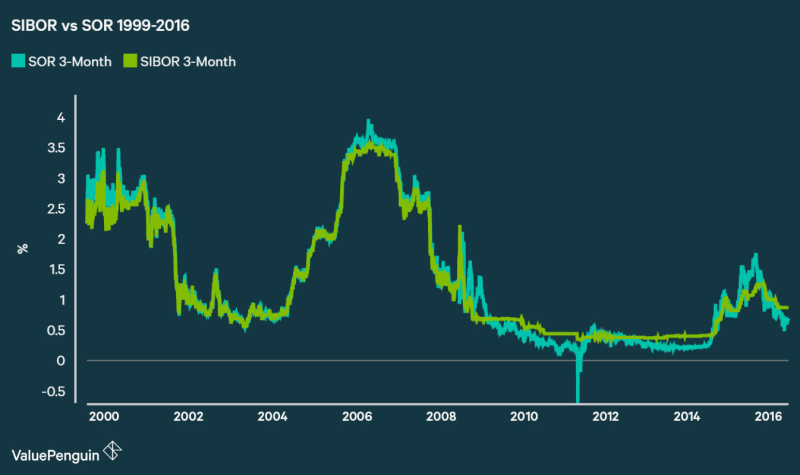

The Singapore Interbank Borrowing Offer Rate, or SIBOR, is an interest rate that banks use to lend money to each other. It is transparent to all, so consumers can make an informed decision whether or not the interest rate is fair.

Most banks offer property loans based on the 1 or 3-month tenor, with the latter being more expensive. Many banks will also add in a spread on top of the SIBOR rate, so your final interest payable could be 3-month SIBOR + 1%.Since a longer period reduces the risk of the market volatility, it is generally of a higher rate.

3. SOR Pegged Mortgages

The Swap Offer Rate, SOR, follows the price of the swapping of the Singapore Dollar in exchange for US Dollars. This may be beneficial to you, especially since the US Federal Reserve fund rate is low now. However, your property loan’s interest rate is susceptible to foreign exchange rate fluctuations, which adds a layer of unpredictability.

Given the impending discontinuation of LIBOR, the Association of Banks in Singapore (ABS) has announced that SOR will transition to an alternative benchmark rate called the Singapore Overnight Average Rate (SORA) within the next two years.

4. Singapore Overnight Rate Average (SORA)

SIBOR, is more unpredictable as it reflects the interest rates that banks have decided to charge in the future for a period of time.

The predictability of SORA is even more evident when it comes to the 90-day SORA, which future home loans are likely to use. This is determined based on the SORA for the past 90 days.

The biggest difference between SORA and SIBOR is that SORA is backward-looking, while SIBOR is forward-looking.

All that being said, many banks have not yet started rolling out SORA home loan packages aside from OCBC as of this time of writing.

Hence, we can’t really compare SORA and SIBOR, and come to a conclusion whether it will generally work out to be cheaper. Based on their respective computations, SORA tends to be lower than SIBOR, but the spread banks will tack on to the rate needs to be taken into consideration.

If you are currently having a loan package under OCBC, do consider if you might want to refinance.

In any case, Sibor will be discontinued by 2024.

5. Board Rate Mortgages

Board Rate Mortgages use the bank’s internal rate to determine the interest rate for your property loan. While the amount is not transparent to you, board rate mortgages have proven to be relatively stable in recent years.

6. Deposit Matching Interest Offset Mortgages

This is a good option if you’re cash rich, as it involves opening up a deposit account along with the property loan. The deposit account’s interest you get monthly will offset much of the amount you spend paying the property loan’s interest. This way, you don’t actually spend much paying the loan interest. But to make the most out of this kind of mortgage, you’ll need a sizeable amount of cash just lying in the bank first.

7. HDB Housing Loan Mortgages

The HDB housing loan is only applicable for for HDB flat purchases, and the interest rate is currently pegged at 2.6%. It is attractive also because of the higher loan quantum, up to 90% of the purchase price or valuation, whichever is lower.

Click here to read more on Bank vs HDB loan!

8. Fixed Deposit Pegged Home Loan Mortgages

SIBOR and SOR have inherent unpredictability in their interest rate. As such, banks have started offering property loans based on their fixed deposit rates instead. Banks will likely not raise their fixed deposits rates drastically, as it reduces the revenue from their fixed deposit business as well.

For most fixed deposit pegged property loans, banks will charge a spread on top of the fixed deposit rate, like Fixed Deposit Rate + 0.58%.

How do I complete the purchase of a property?

Once you’ve settled on a property, you’ll need to engage a conveyancing lawyer to help in the transaction. The cost is around $2,500.

For an EC or private property purchase, you can loan up to 80% of the property valuation or purchase price (the lesser of the two), and use up to 15% from the CPF ordinary account. You will need to pay the remainder in cash.

The lawyer will pass you a copy of the sales and purchase agreement, which you will need to bring to the bank to confirm the disbursement of the loan.

Going forward, the bank will debit the monthly instalment from your savings account until the loan repayment is complete.

Conclusion

Purchasing a property is a long-term commitment and involves a huge sum of money. In order to get the best deal, make sure you check out the major banks and see which offers the most bang for the buck.

In a competitive industry like property loans, you can find great deals if you look hard enough!

Leave a Reply